Checking

Accounts designed to grow with your business.

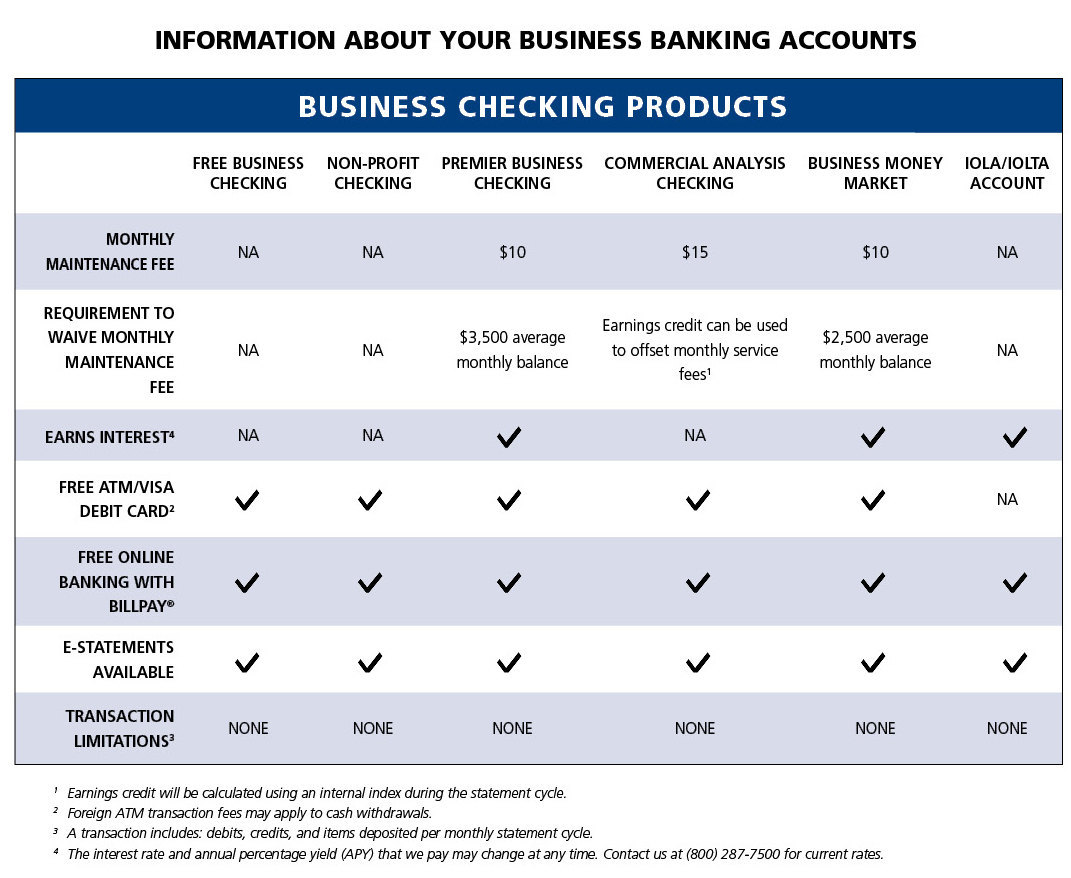

Free Business Checking

NECB's Free Business Checking account is a basic checking account that is excellent for your small business — with no monthly maintenance fee, no minimum balance requirement, and no monthly transaction limitations.

Non-Profit Checking

A free account that allows not-for-profit businesses to focus on their missions and forget about fees. The account features a Business ATM/Visa Debit Card and can be used for online banking. There are no transaction limitations.

Premier Business Checking

An easy and efficient way to manage your business banking relationship while you’re earning interest, the Premier Business Checking account is designed for a customer's moderate transaction volume, with an average monthly balance of just $3,500 to waive the low monthly maintenance fee(s).

Commercial Analysis Checking

Commercial Analysis Checking with account analysis is a cost-effective account designed for businesses that have larger transaction volumes and need to utilize a full range of business banking services. It offers the ability to use account balances to offset some or all monthly fees through earnings credits.

IOLA/IOLTA Account

Interest on Lawyers Trust Accounts are specifically designed for law firms and practitioners that are required to hold funds on behalf of their clients. There are no regular monthly maintenance fees. IOLA (NY) and IOLTA (MA) are interest-bearing accounts, but the interest is pooled and provides the money for grants to non-profit civil legal services providers in-state.

Business Money Market Account

This account allows your business to earn interest on savings balances, and you can draw checks on the account. Just keep an average monthly balance of $2,500 to avoid the low $10 monthly maintenance fee. The Business Money Market account features a variable interest rate than can change at any time.